Oils and fats are essential for human nutrition and health. They are important components in most foods and beverages because they deliver energy, essential fatty acids and flavor, among many other things. However, the oil and fat sector is facing new demands and unprecedented challenges as our food system is rapidly evolving to include alternative protein products. The industry needs new and complementary approaches to deliver the solutions that the people and the planet deserve.

MISTA is a multi-dimensional innovation platform created to accelerate food tech innovations. It works with a consortium of large food and ingredient companies and start-ups. During a recent Fireside Chat held in March 2022 for its members, MISTA led a panel discussion on the future of oils and fats. Below are a few highlights of the new approaches and technologies that could reshape the oil and fat industry.

Challenges and opportunities with oils and fats

Let’s start with a few definitions: oils and fats are lipids, a class of organic compounds that are fatty acids or their derivatives and are insoluble in water. Oils are liquid at room temperature, and fats are solid. Note that beyond their use in foods, oils are also central to many other industries (chemical, biofuel, personal care, etc.), but this won’t be covered in this entry.

The oil and fat industry has historically relied on animal and plant derived fats and oils and has developed a large portfolio of products and ingredients over the decades. However, the current offerings don’t provide solutions to satisfy all of the food industry’s evolving needs. An emblematic example of this mismatch is the food industry’s addiction to palm oil, which is increasingly rejected by consumers on sustainability grounds, and has a limited range of affordable, scalable, healthy and ethical solutions to replace it. The food industry is also following macro trends calling for innovations, such as the need for vegetable fats and oils able to deliver the melting profile and sensory attributes of animal fats for plant-based meat products.

The current conflict between Russia and Ukraine further exposes the fragility of the vegetable oil supply chain as these two countries produce and export over 70% of sunflower oil. This adds to the already limited soy oil supply due to drought in South America and constrained palm oil supply squeezed by Indonesia’s export curbs. This perfect storm is leading vegetable oil prices to sky rocket.

It does seem that the oil and fat industry is ready for a shakeup, doesn’t it?

New approaches to oils and fats – the technology landscape

If you have been reading the food innovation press recently, you have likely noticed a flurry of announcements related to milestones and funding events for multiple start-ups in the oils and fats arena (e.g. Zero Acre Farms raised $37M, Yali Bio raised $4M, and Lypid raised $4M, to mention just a few).

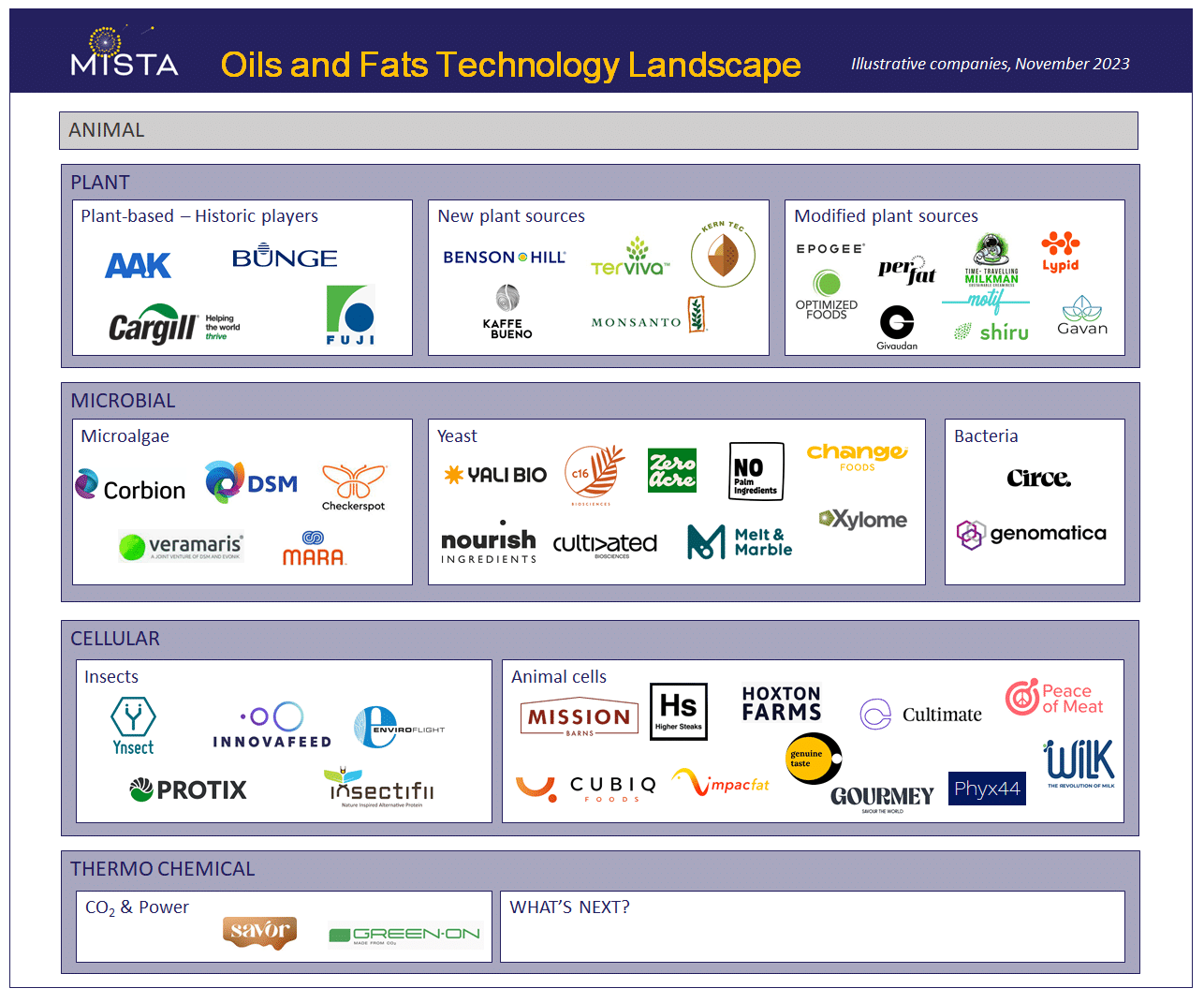

To help visualize the space, MISTA has developed a simple framework to articulate the oil and fat technology landscape. During the mapping of this ever evolving field, over 40 new technology companies have been identified. Only some of them are represented on this chart, or mentioned below for illustrative purposes. If we missed you or misclassified you, please reach out and let us know 😉

At a high level, the fat and oil sector can be broken down into 4 main quadrants based on the origin of the ingredients, as illustrated in the chart below.

- ANIMAL – Animal fats and oils are a by-product of the production of another animal product like lard or tallow. They present some beneficial characteristics (e.g. taste, melting profile) and are commercially available at large scale and a competitive cost. They clearly play an important role in our food supply, but they are also associated with issues like intensive animal production conditions and human health concerns, to name a few. I chose not to focus on the innovations for this class of oils and fats in this post.

- PLANT – Plant and nut derived oils have been the staple of our alimentation for millennia and are critical to the global food system. The largest volumes are coming from palm and soy, which, depending on their cultivation conditions, can create sustainability and consumer acceptance issues. In addition, new food categories are demanding new functionalities that cannot all be provided by the historic vegetable oils. These are the perfect conditions to encourage innovation in the space, and many companies are acting on the opportunity.

- Historic plant sources – Many plants have been cultivated for their oils throughout history (e.g. palm, sunflower, coconut, olive, peanut). Their production processes can range from rather simple (e.g. physical press) to fairly complex (e.g. extraction, fractionation, esterification). Historic oil players are constantly innovating and adapting their products to fulfil the demands of the food industry. For example, AAK’s AkoPlanet™ solutions are developed to enable the formulation of plant-based foods while ensuring a sustainable and traceable supply chain (e.g. no primates used in the harvesting of coconuts; lower climate impact processes).

- New plant sources – Luckily, nature has many routes to oils, and several companies are leveraging this boon (and I am not only talking about cannabis derived oils). For Terviva, producing oil is not the only goal. Indeed, Terviva is growing Pongamia, a climate-resilient tree which helps to reforest land and revitalize communities. It just happens to produce a great culinary oil too. On the other end of the spectrum, companies like Benson Hills deploy cutting edge breeding technologies to improve the characteristics of row crop plants, like increasing the content of healthy oleic acid in soybean oil. Yet another approach leveraged by Kern Tec is to extract oil from fruit pits(apricots, cherries, and plums), which are typically discarded.

- Modified plants sources – As described above, processing and modifying oils to improve their functionality is not new. However, an increasing number of new players are entering the space with novel approaches. For example, Lypid is microencapsulating liquid plant oils in water to create solid fats with very high melting points. Givaudan’s PrimeLock+ technology mimics animal fat cells with encapsulated coconut oil to reduce fat content and control fat and flavor release during the cooking process. Motif FoodWorks is developing oleogels that enable the co-extrusion of vegetable oils with plant-based proteins, emulating the marbling of conventional meat. Epogee inserts a food-grade propoxyl connector and re-links the fatty acids and glycerol, to make a material that looks, feels, tastes and cooks like fat. Protera Bio has developed a new biocatalyst to optimize the melting point of vegetable oils, without generating trans-fats.

- MICROBIAL – Microbes are cool! Sorry I am biased, but you have to admit that they have an impressive ability to transform a variety of carbon sources into biomass and molecules of interest via fermentation. This ancestral process that can lead to exquisite wines and cheeses can also be industrially controlled to produce oils. This process requires less land and water and often releases less carbon dioxide than other production methods. The oil composition can also be tweaked to specification, potentially leading to more functional or healthier oils. Scalability and cost viability has already been proven for high value oil applications, but still has to be demonstrated for commodity use.

- Microalgae – You may not realize it, but the reason fish have a high content of omega-3 oils is because they eat microalgae. These ancient unicellular water plants are indeed earth’s initial oil producers. Martek, now part of DSM, was the first company to develop a process to grow microalgae in industrial fermenters to produce omega-3 oils. DHA is now commonly used in baby formula and other foodstuffs. Solazyme/TerraVia developed a whole platform around microalgae, some native and some genetically engineered, to tailor oil profiles for specific applications. TerraVia was later acquired by Corbion, and is now commercializing a DHA rich product for aquaculture derived from a naturally occurring microalgae species. More recently, companies like Checkerspot have been revisiting the ability to modify the profile and properties of the oils produced by microalgae, for a wide range of applications.

- Yeast – There is a multitude of yeast strains in nature and many found their way into the production of foods and drinks we enjoy daily, like bread and beer. But these little organisms are also oil producers and several start-ups are intending to put them to work. Yali Bio is deploying a synthetic biology approach to engineer yeast to produce oils that would be better suited for plant based meat. Similarly, Zero Acre Farms is working on a new category of healthy oils and C16 Biosciences is targeting palm oil replacement. NoPalm Ingredients is also aiming to replace palm oil, but their approach is to feed food side streams to naturally occurring yeast strains in a circular fermentation process. Leveraging fungi (not exactly a yeast but close enough for this panorama), Mycorena has created a structured fat by growing fungal mycelium with vegetable oil, to emulate animal fat properties.

- Bacteria – Bacteria can also be cultivated in fermenters to produce molecules of interest. To our knowledge, only a few companies are exploring this route for food oils. A young start-up, Circe, is one of them, and their goal is to decarbonize oil production by actually using CO2 as a feedstock for their microbe. On the industrial side and using more conventional carbon sources, companies like Genomatica utilize bacteria to produce fatty acids, building on technology acquired from REG Life Sciences.

- CELLULAR – The last type of approach we want to illustrate relies on animal cells to do the oil production: industrially grown insects or animal cells cultivated in incubators. For these approaches, in addition to the initially high set-up costs and scalability aspects, other challenges are looming. Beyond the regulatory approval process that can be lengthy, consumer acceptance will have to be demonstrated and labeling practices harmonized in some geographies.

- Insects – Insects are part of the traditional diets of at least 2 billion people and insect fats are used to fry food in several regions. But we are not quite there in Europe and North America. Industrial insect protein production can lead to the production of insect oil as a by-product (oil can represent up to 30% of the fresh weight of the insect). Insect oil has already been accepted as a sustainable feed ingredient for farmers as an alternative to vegetable oils regularly found in swine and poultry feed. The elevated levels of lauric acids and omega-3 fatty acids may even have some health benefits for the animals. We’ll keep monitoring the human food space in the Western world for acceptance.

- Animal cells – Last but not least is the category coined as cellular agriculture or cultivated fat. The concept is to isolate a single cell from a live animal (a cow, a pig or a chicken) and then multiply it in controlled conditions in a bioreactor or incubator. Many start-ups are following this approach, such as Mission Barns, MeaTech, and Peace of Meat, albeit all with a slightly different spin. Gourmey is a company specifically targeting the foie gras application (yes, they are French). Cubiq Foods is developing animal fats rich in omega-3 fatty acid. For all, the promise is to deliver “real” animal fat without the cruelty and in a more sustainable manner. Like the general cultivated meat sector, the challenges are around cost of production, scale-up, regulatory approval and labeling. Could such cultivated animal fats be used in a 100% plant-based meat burger?

MISTA exists to help transform the global food system to meet the needs of the future. We can only rejoice that the topic of the future of oils and fats has finally grabbed the attention of the food industry, the consumers, the investors and the technology innovators. We are convinced that multiple solutions will have to be developed, scaled and commercialized to help transform the way we produce food. We are not here to pick winners, but to potentially accelerate the transition.

About the author, disclaimer

I am Céline Schiff-Deb. By training, I am an agronomist and plant molecular biologist, and for the last 20 years I have been working at the interface of science and business, translating biotech innovations into relevant commercial products and services in the areas of food, feed, specialty chemicals, agriculture, and cosmetics. I joined MISTA as Head of Biotechnology in January 2022, and this article represent my own views. My interest in oils is not new. Between 2013 and 2017, I have worked for one of the most innovative and advanced company in the alternative oil space, Solazyme/TerraVia. I am thrilled to be part of the leadership team at MISTA and working closely with our MISTA members to help redefine the oils and fats space.